Previous Stock Report on MNI:Parent Company of Macon Telegraph, The McClatchy Company Facing Tough Times

Back in January I reported that McClatchy was facing tough times and at that time was trading at $2.95 a share. Since then the shares have continued to nosedive and closed trading this past Friday at $1.98 a share. This was actually a small rally since they had dipped to $1.87 earlier in the week. But this still a new 52-week low.

People have begun to speculate about penny stock status in the not too distant future. Even at $1.98 it’s more subject to manipulation by stock promoters and pump and dump schemes than companies on firmer footing.

McClatchy Co. saw 600,298 shares of its stock trade hands, that’s out of 87.1 million shares outstanding. The stock has an average daily volume of 309,231 shares. After hitting a new 52-week low, McClatchy Co. enters the new trading day with a market cap of 172.46 million, a 50-day SMA of $2.81 and a 200-day SMA of $3.89. It is currently trading at $1.93 as of Noon March 9, 2015. Insiders have also been trading their shares in volume recently including the CEO mostly around $2.32 a share.

There are now increasing calls for CEO Pat Talamantes to resign. It looks like a race against time to right the ship. A few numbers: $1 billion in debt and cash flow from operations at $82 million, add back depreciation of $110 million, then subtract projected 2015 interest costs of $80 million and capital expenditures of $20 million and you have $92 million to reduce the $1 billion in debt in 2015. Those are not promising numbers that will get anyone excited. But here is the rub, cash flow has dropped around 20% in each of last 2 years. Now that trend is abating only because 35% of revenue now comes from print ads…. but still with a no growth/negative growth future. The outlook is grim indeed.

What can any CEO do at this point in time? They indicated they have cut expenses to the bone. They have some breathing room under the debt covenants. After selling off some of their most valuable assets like their stake in cars.com I am not sure anything can be done under the current leadership in the short term. A long term fix is really needed but do they have enough time and more importantly do they even have a strategy to increase profits.

Print media as a whole is mostly dying, some companies faster than others. But there are certainly changes that need to be implemented fast if McClatchy are to have any chance at all to survive and compete in the new digital age. I have seen scant evidence of the type of changes I think are needed. Their websites for newspapers are ad ridden that look more at home on a computer running Windows 95 than on an iPad which is where they need to shine.

A few of their rivals are faring better than McClatchy because they are more diversified with tech and T.V. Holdings. Both Tribune Media and Gannett have posted some positive results recently. That is not to say those companies do not face issues of their own but they at least seem to have a better grasp on a model that is sustainable than McClatchy. Here are some related companies.

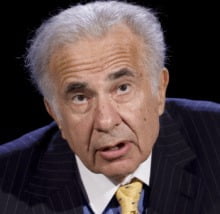

McClatchy is fast becoming a prime target for capital vultures like Carl Icahn. Icahn has already been sniffing around Gannett and trying to exert his influence. Only recently he withdrew his nominees to Gannett’s board, ending a proxy fight with the USA Today publisher ahead of its planned split of its print and broadcast divisions. Gannett also owns the local CBS affiliate in my market 13WMAZ. Icahn is not exactly a quitter but he may turn his attention to an easier target.

Icahn may not be able to have any influence on a company as big as Apple, but McClatchy only has a tiny market cap of $172.46 million. That is peanuts to Carl Icahn and he could probably find that under his sofa cushions. But why would he be interested?

Location, location, location!!! McClatchy owns some prime real estate and their assets have some value even taking their debt into consideration. Not long ago they sold the Anchorage Daily News to a very nimble competitor that started out as a blog called the Alaska Dispatch. Much of the actual value of this sale was for the building itself and not the paper.

Icahn and others can see the value of these real estate holdings and other assets. They are an attractive target to any vulture capitalists looking to make some quick money because they are so vulnerable. Take a look at their recent quarterly to see what I mean.

I want to stress that Carl Icahn has not contacted me personally so all of this is sheer speculation by someone that has been pretty good at reading the tea leaves in the past when it comes to McClatchy. They might be too small for Icahn to take any interest but it is only a matter of time before Icahn or some other vulture smells the blood and swoops in if McClatchy doesn’t turn things around fast.

If McClatchy want to stay in the print journalism business they need to make some big changes and fast. Their websites for their newspapers are very similar which is not a bad thing if you have an excellent GUI (Graphical User Interface), but unfortunately their websites look very dated and full of ads. They do this presumably to save money on IT people by having it all done from one location but this means local papers have very little control to make changes or fix errors.

They are also going to need to figure out a way to convert local businesses in their markets to higher online ad revenue. They don’t need ad partners like Google Adsense or others. Too many fingers in the pie. They need to have their own ad department selling and managing these ads entirely own their own and keeping all the profits not a small percentage. Ads alone are also not the answer and they need to figure out some other revenue streams as well since subscriptions and ads will not be enough on their own.

I understand the need for online ads as an income source, but it has now reached a tipping point where people are too frustrated to even view their websites because there are too many. This is a delicate balancing act but they need to figure out a sustainable model that will produce profits while not driving traffic away. It becomes a vicious cycle where they are forced to increase online ads for revenue but additional ads then drive traffic away.

A good example of a news source that did a decent job of updating their digital presence is CNN. It is far cleaner and more intuitive than their old design and this is especially true on their iPad version. Visits to CNN.com have spiked since they adopted their new look. If McClatchy want to use a one-size fits all approach to their various newspaper websites they better come up with a more modern version and soon. Personally I think local papers need some flexibility to tweak and adjust the site to suit their own market. Using Facebook for commenting was also a big mistake as it adds to load time and seems poorly integrated.

I am not sure if Talamantes has the digital acumen to implement the needed changes for McClatchy to rebound. He is no Steve Jobs or Tim Cook. He is a great bean counter but they need a visionary. Right now he is playing to survive not to thrive. The Taboola deal is a band aid for a broken leg. McClatchy needs a complete overhaul from top to bottom. The current CEO and executives have been tied to the current business model for such a long time it would likely take replacing them all to enact the type of changes needed for a real turnaround.

Until I see stronger evidence than a content widget deal like the one with Taboola, I am not optimistic about the longterm prospects for McClatchy.

For these reasons I rate McClatchy (MNI) as a STRONG SELL

Previous Stock Report:Parent Company of Macon Telegraph, The McClatchy Company Facing Tough Times