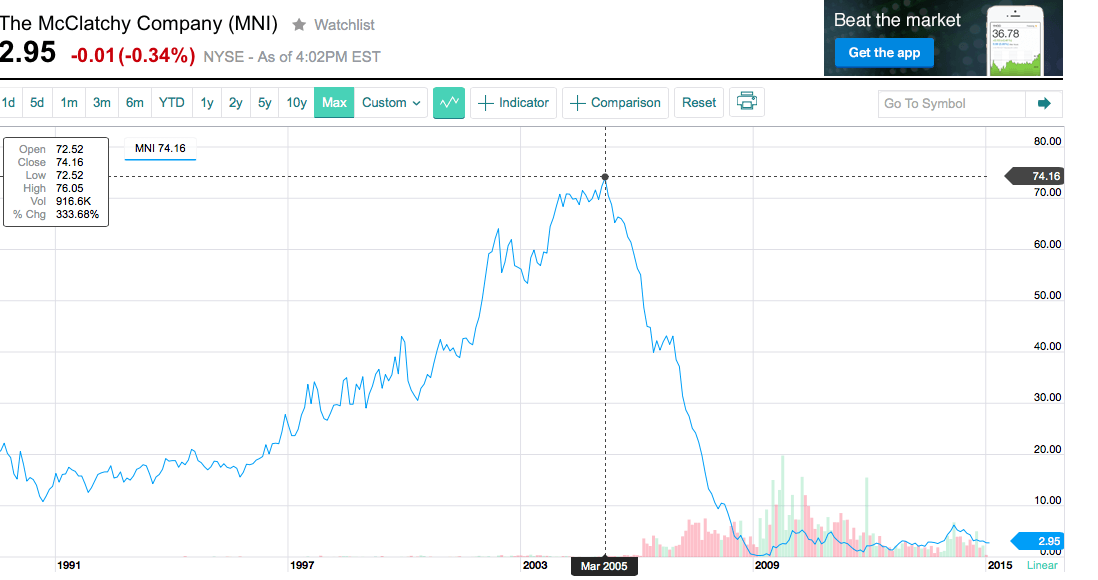

The McClatchy Company (stock symbol MNI) closed trading today at $2.95 a share. In March of 2005 it traded at $74 a share. McClatchy is based in Scaramento, CA and operates 30 daily papers. It acquired the Macon Telegraph when it purchased Knight Ridder in 2006. It also owns the Ledger-Enquirer in Columbus, GA and larger papers like ones in Fort Worth, Charlotte, and Miami.

Sentiment and enthusiasm for this stock has weakened considerably. One analyst site had this to say about McClatchy and listed it as one of four stocks to sell now. “McClatchy Company Class A (MNI) earns a D this week, moving down from last week’s grade of C. McClatchy publishes daily and non-daily newspapers located in western coastal states, North and South Carolina, and Minnesota. The stock gets F’s in Earnings Growth and Sales Growth. To get an in-depth look at MNI, get Portfolio Grader’s complete analysis of MNI stock.”

McClatchy is pinning it’s hopes on a revival of digital media publishing. By selling online subscriptions and with online ads. McClatchy only recently sold their large stake in cars. com to rival Gannett Co. The reasons cited included money for servicing outstanding debt and to help complete a transition to digital media subscriptions.

Market Watch in reference to McClatchy wrote: “First among the most troubled newspaper companies in America is McClatchy Co. (NYSE: MNI), which took on an extraordinary amount of debt to roll up large newspaper companies. While falling revenue may be a survivable situation for some of the industry, at least for now, McClatchy has to find a way to survive, or sell itself off in pieces.”

The report went on to say that McClatchy’s revenue had fallen to $292 million from $302 million in the same quarter from a year earlier. McClatchy also has a debt load that forced it to pay $33 million in interest expense and likely forced the sale of Cars.com to much larger rival Gannett Co. who also owns local CBS affiliate WMAZ Unlike McClatchy, Gannett has a far more diverse group of holdings that include TV stations in addition to their newspaper and other assets which now includes cars.com

The long-term debt is a grim $1.5 billion, and when your entire market cap is only $294 million that is a rather large sword of Damocles circling above your head. Heavy debts like these make it improbable they will be able to dig their way out while retaining all their current assets.

Their main rival Gannett (Stock Symbol GCI) has a market cap of $6.96 billion compared to McClatchy at $258 million. Gannett Co. is currently trading around $30.78 a share.

McClatchy Co. Outlook Grim

Similar to the now infamous Sprint purchase of Nextel, the Knight Ridder acquisition might have been a bit too big of a deal to digest for McClatchy as their $1.5 billion debt would indicate. Not all mergers or acquisitions turn out as expected as both Sprint and McClatchy seem to have learned the hard way. Since the Knight Ridder purchase the stock has continued on a long a steady spiral downwards and shows little sign of abating anytime soon.

Print media faced the first big competition with the advent of radio and TV. Newspapers managed to survive but the number of subscribers continued to decline especially once 24 hour news channels like CNN and others appeared. The internet hastened the decline further as people gained access to more timely and comprehensive news for free. The internet has already been the final nail in the coffin for many newspapers and McClatchy seems to be a prime candidate as well as they have failed to keep up. Even storied and large papers like the New York Times have needed to revamp, adapt, and issue layoffs as they reinvent themselves for the digital age.

Some online only papers have managed to prosper in the digital age like Huffington Post. But McClatchy is far behind the competition. Their sites are clunky, slow and have seen few updates in many years. Their digital articles t fail to include pertinent hyperlinks or to integrate videos in articles. They rely on a slow or broken adaptation of Facebook for commenting instead of Disqus or Livefyre found on most news sites. They are deathly afraid that if you leave their ad ridden sites you won’t return, and they are probably right. It becomes a vicious cycle of adding ever increasing ads to pay the bills and having those same ads scare visitors away. McClatchy have failed miserably so far to reinvent and adapt their newspapers to the digital age which desperately needs a massive makeover.

McClatchy will be likely be forced to sell off bits and pieces to stay afloat. Before they sold their stake in cars.com they also sold the Anchorage Daily News to a very nimble competitor that started out as a blog called the Alaska Dispatch. Much of the actual value of this sale was for the building itself and not the paper.

Could the Macon Telegraph be next? 😉